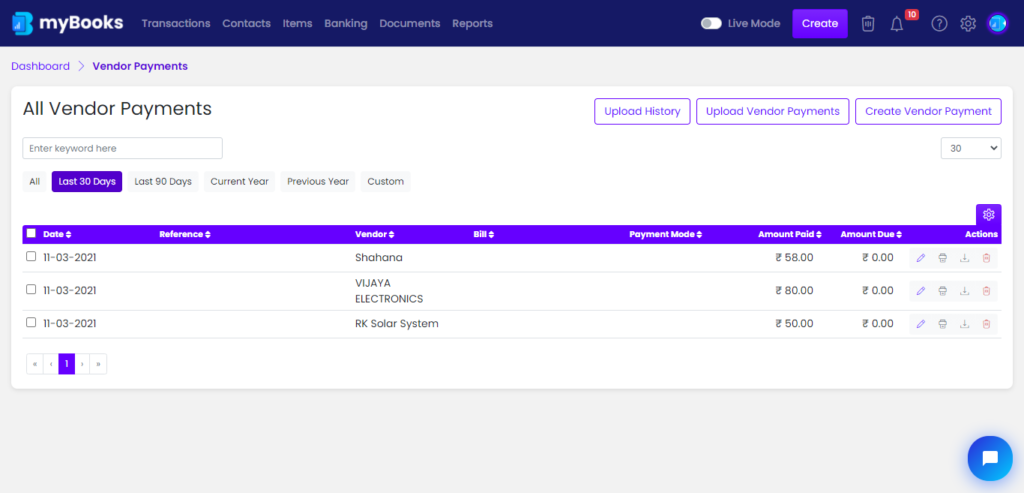

When a company order goods from a supplier, they raise a Bill, when the goods or services arrive they will receive an invoice from the supplier. If the goods or services match the bill, then details of the invoice are entered into the vendor payment, it helps to track how much money is going out of the business.

How to get there!

How to get there!

To create a vendor payment in myBooks click on Transactions > Vendor payments> Create vendor payment or click on Create which is located in the top right-hand corner and then click on Vendor payment.

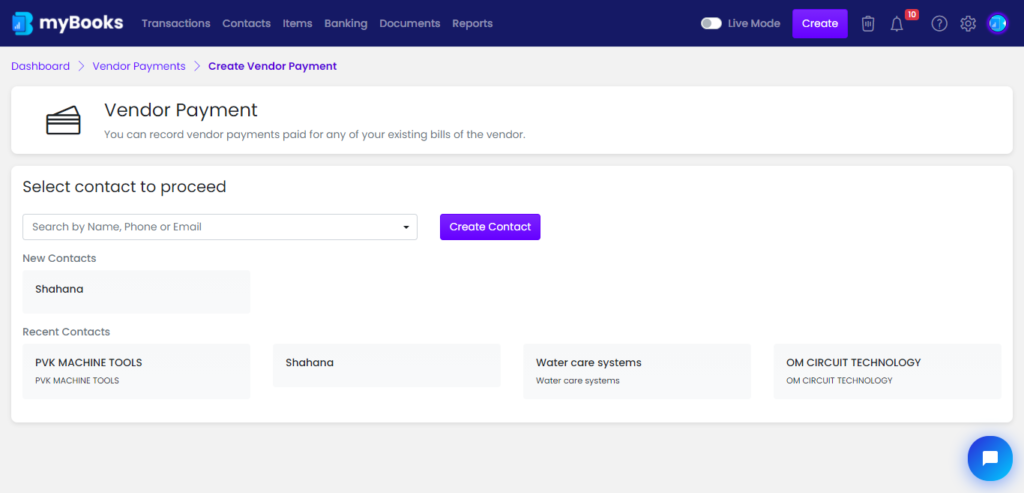

To create Vendor Payments

First, select the vendor from the dropdown or new contact can be created by clicking on add new contact.

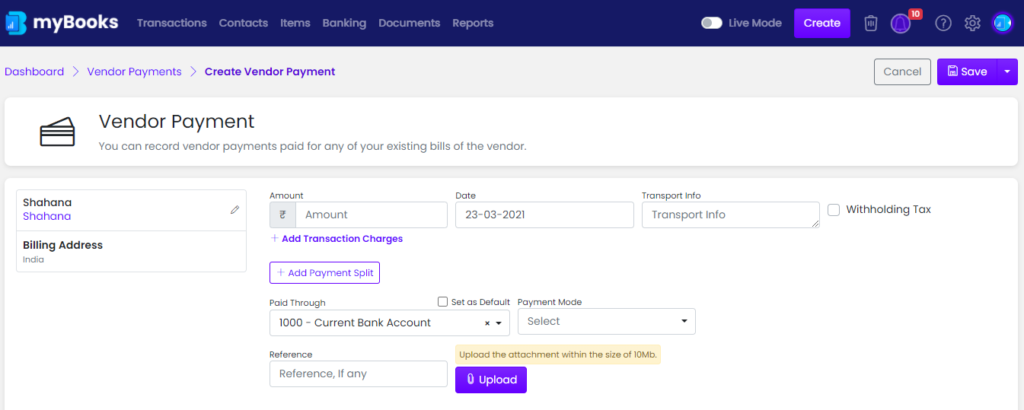

Payment Details

Enter the amount in the Amount field and select the date from the calendar. Click on Add Transactions Charges to add your transaction charges. To add the payment split click on Add Payment split. Choose the account that you want to pay from Paid through drop-down and the selected account can set as default. Once the bank account selected, it will display the current balance.

If the tax amount needs to be withheld, then click on Withhold tax. Two fields should appear once click on withhold tax. Select the Tax account and Payment mode from their respective drop-down.

To add tags to the transaction, click on Tags and select from the dropdown. By default created contacts and items would be added as tags automatically.

Bills

- Once the vendor name is updated, bills of that vendor will appear. Select the bill and enter the tax and payment. Tax will appear only if withhold tax is chosen. Then click on save to save the payment.