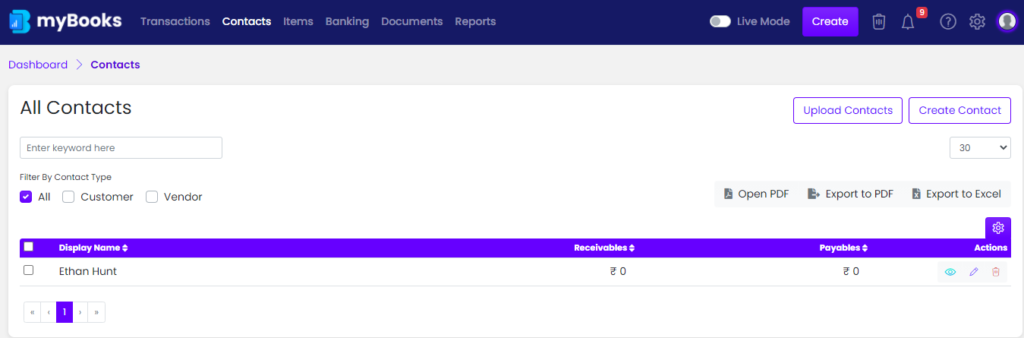

How to create Contact

GST verification – If your contact is GST registered then enter their GST Number. If not select Non-registered. Based on GST number and GST treatment will load.

GST number – GST number will load in myBooks if the option registered is selected.

GST Treatment – GST Treatment will be loaded based on the selected GST verification option. If registered is selected, the below-mentioned treatment will load.

Deemed exports – EOU’s, STP’s EHTPs, etc.: Is a customer who has a business that is registered under GST and falls in the category of companies (EOU’s, STP’s EHTP’s, etc.), to which supplies are made they are termed as deemed exports.

eCommerce – Where your products are sold through websites like Amazon, Flipkart, etc. (currently not supported in myBooks)

GST regular – Regular – A customer business that is registered under GST and has a GSTIN (doesn’t include customers registered under composition scheme, as an SEZ or as EOU’s, STP’s EHTP’s, etc.)

GST registered – composition – A customer business that is registered under the composition scheme of GST and has a GSTIN.

Overseas – Is a customer who has a business which is located out of India.

SEZ – A customer who has a business that is registered under GST, has a GSTIN, and is located in an SEZ or is an SEZ Developer.

UIN holders – UIN is a special class of GST registration for foreign diplomatic missions and embassies which are not liable to taxes in the Indian Territory. Any amount of tax (direct or indirect) collected from such bodies is refunded back to them.

For non-registered, below options will load in GST treatment.

Consumer – A customer who is not registered and the final consumer of the service or product sold.

GST unregistered – A customer business that is not registered under GST and does not have a GSTIN.