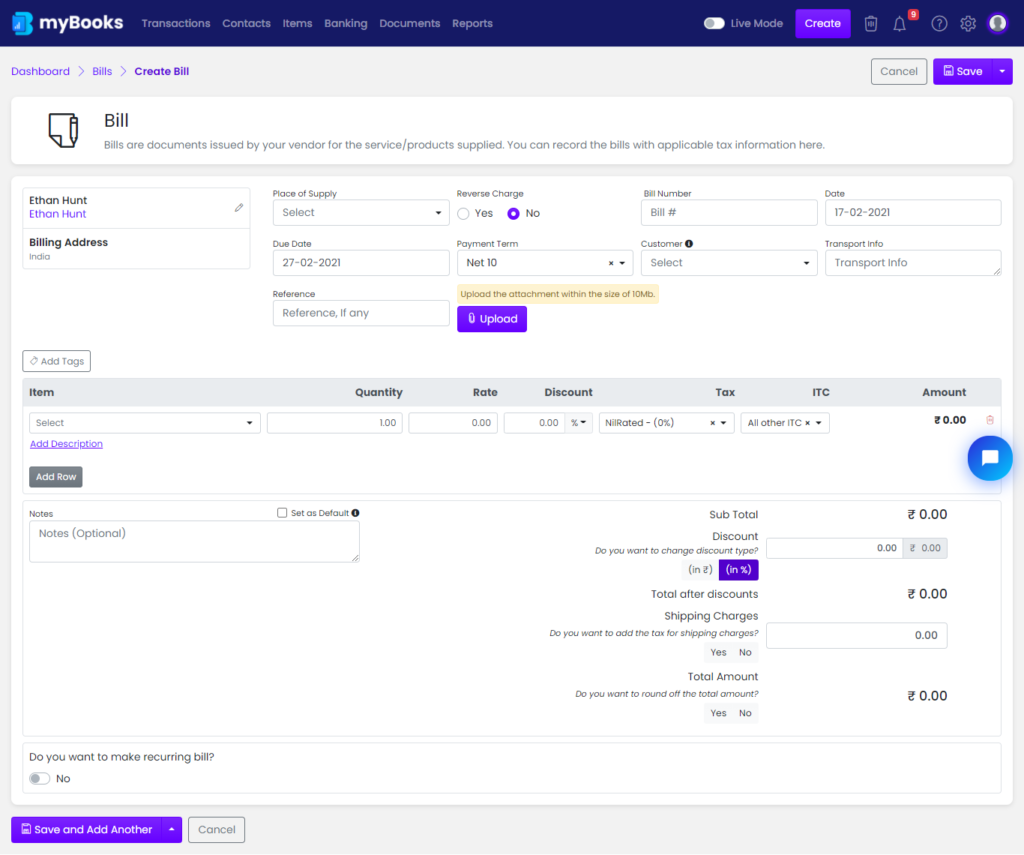

Place of supply – Determine whether the transaction has to levy inter or intra tax in mybooks and based on the GST treatments, GST and IGST tax will load in mybooks.

Reverse charge – Reverse charge will only load in purchase transactions. Reverse charge means normally your vendor will pay for the tax which was bought by you. Incase if your vendor is not registered then responsibility of paying those taxes will be levied by the person who bought the goods.

Port codes – If the product is bought from other states. Port code must be mentioned in expense transactions. In myBooks, port codes will load only if another state or overseas is selected.

Taxes – In myBooks, the tax will load based on the place of supply. If the home state is selected then GST tax will load and if another state is selected then IGST tax will load. For Deemed Exports, Overseas and SEZ only IGST taxes will load even if the home state is selected in myBooks.

ITC – ITC means Input Tax Credit reducing the taxes paid on sales, from the taxes to be paid on purchases. ITC can be selected from the preloaded list in myBooks.