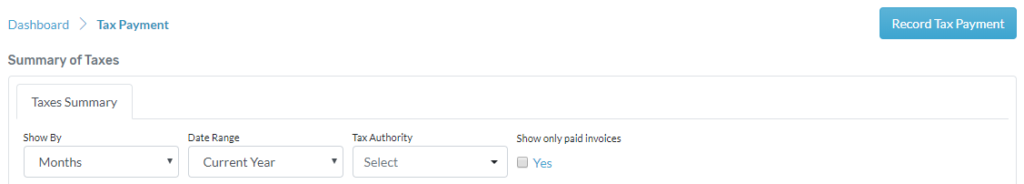

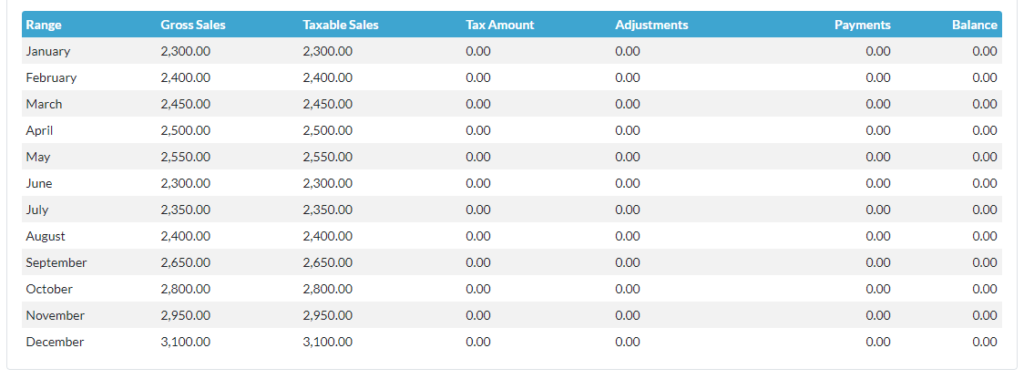

Taxes which are created in invoice and customer credit notes will be displayed here. This report can be generated for year and months.

How to get there!

How to get there!

To Create tax payment in myBooks click on Transactions> Tax payment > Record Tax Payment.

Create Tax Payment,

- Go to transactions

- Click on Tax payment mentioned under others

- Once the tax payment is clicked, tax payment will automatically generate for current year

- To run report for different year

- Click on show by and choose from the drop down menu

- Click on date range and report will generate automatically

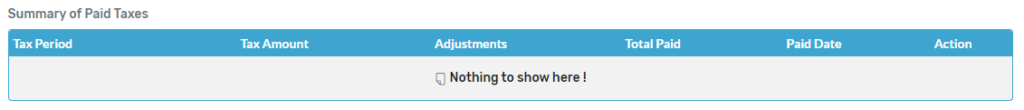

Record payment

- Go to transactions

- Click on Tax payment mentioned under others

- Click on record payment located at top right-hand corner in summary of taxes

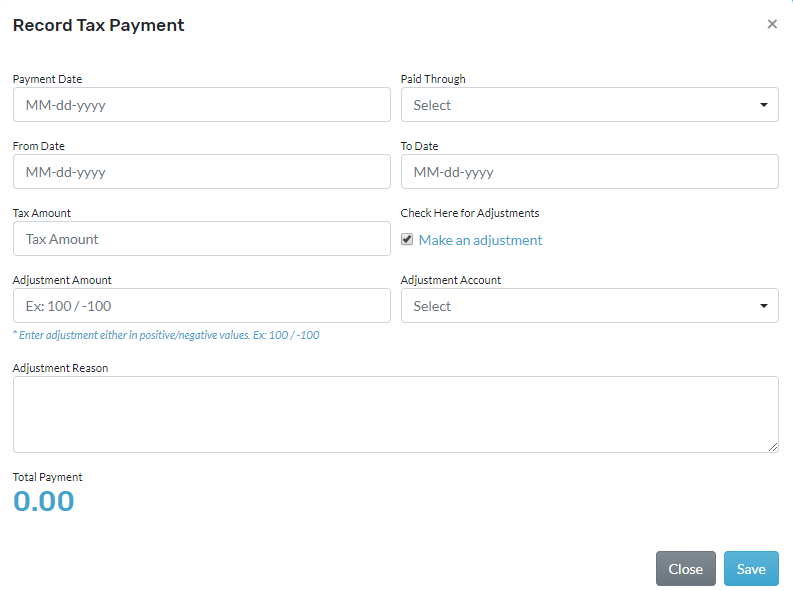

- Choose the date from the dropdown for the payment date

- Select the method of payment for paid through field

- Choose the from and to date from the dropdown menu

- Enter the tax amount

- If there is adjustment for this tax payment, you click on make an adjustment

- Three fields will load, you can enter the adjustment amount and you can select adjustment account from the dropdown menu

- Type adjustment reason for this entry and click on save to save the tax payment