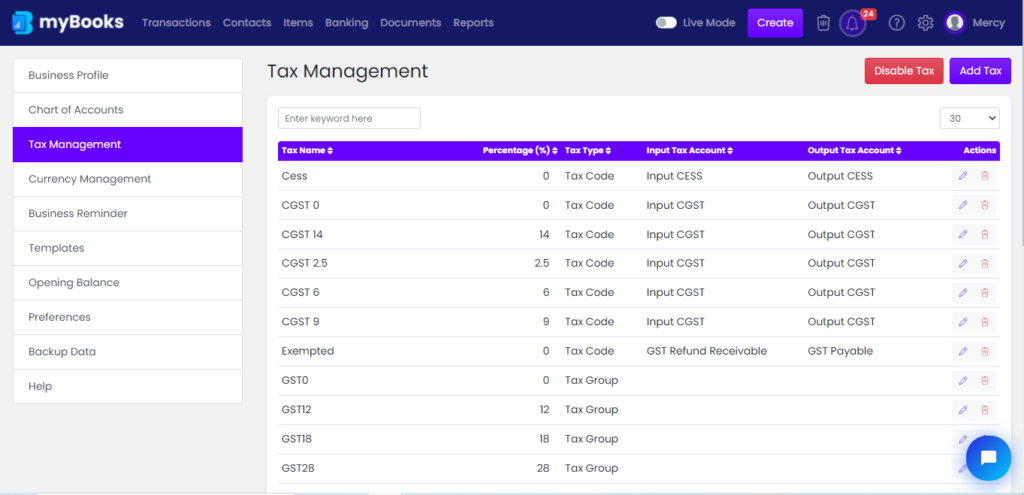

To create tax management in myBooks click on Settings > Business settings > Tax management >Add tax

Here you can edit the tax, delete the tax, add the tax, enable the tax, and disable the tax

Add Tax

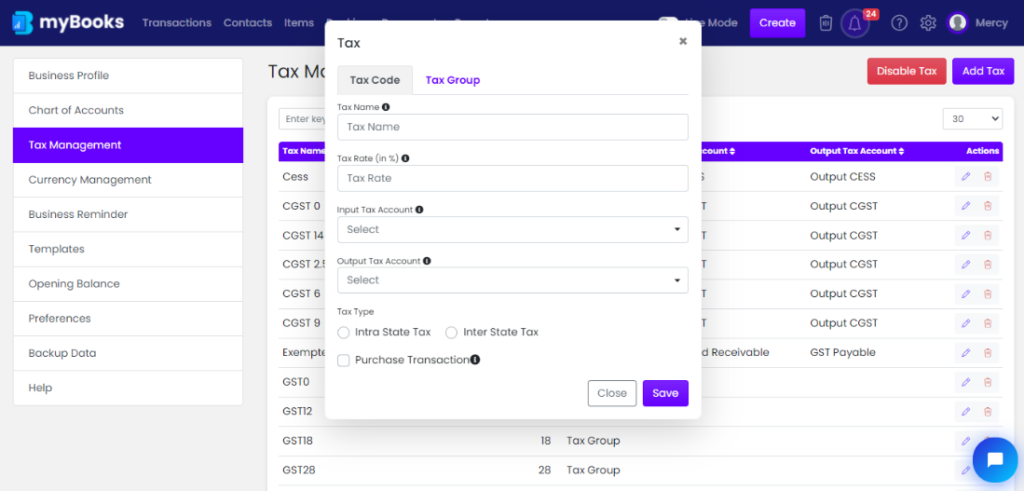

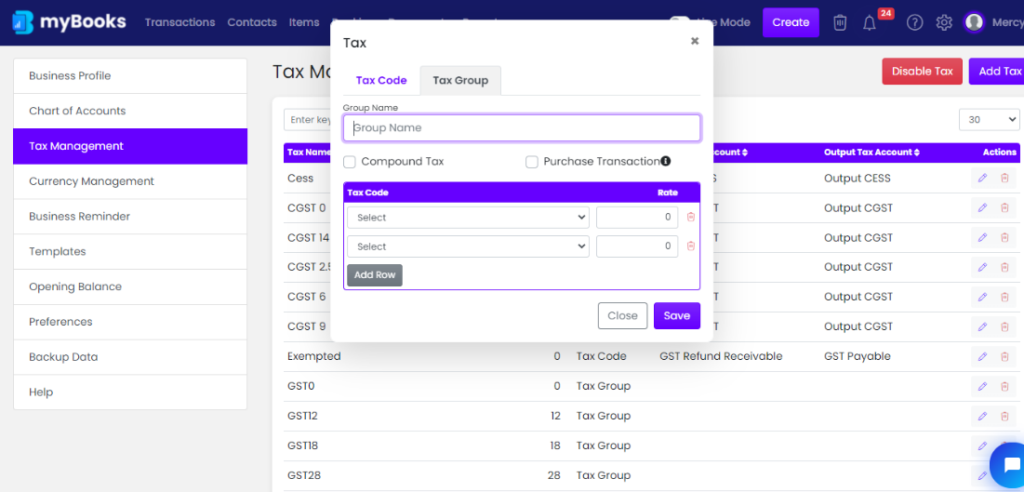

Here you can add the new tax code and tax group

Tax name: The name of the tax like GST 5%. Each tax name has a tax type, tax rate, and account to which you charge tax amounts.

Tax Rate: The tax rate is the percentage of an income or an amount of money that has to be paid as tax.

Input tax account: Select the input tax account from the drop-down menu.

Output tax account: Select the output tax account from the drop-down menu.

Tax type: It is an interstate tax or intrastate tax

Purchase transaction: Click on a purchase transaction to get into your purchase-related transactions

To create a tax group, you need at least two tax codes. Enter the group name and select the tax codes from the dropdown. Please save to create tax groups

Enable/ Disable tax

You can enable or disable the tax. If you disable the tax, it will not be displayed in the transactions.

If you enable the tax, it will be shown in transactions