Financial transactions of the business which are recorded in detail are called a journal. These journals are created so that the reports can be created, such as the general ledger. There are two types of journal those are accrual method and the cash basis method.

The difference between the cash and accrual method is the timing of when revenue and expenses are recognized. In the cash method accounts for revenue are recognized only when the money is received and expenses are recognized only when the money is paid out. In accrual, method revenue is recognized when they are earned and expenses are owned when they occur.

How to get there!

How to get there!

To create journal in myBooks click on Transactions> Journals > Create journal.

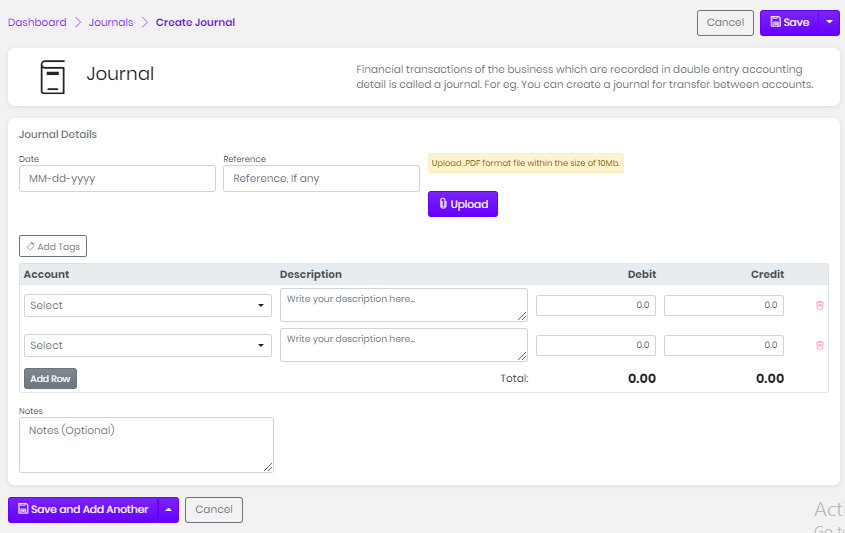

Create Journal

In the New Journal tab there are two segments; General Journal Details and Journal Item Details. When creating a journal both debit and credit should be equal.

General Journal Details

- Click on Journals and then New Journal

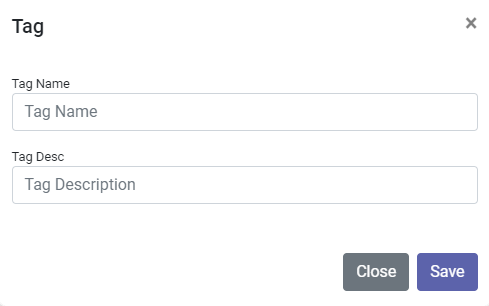

- The tag can be added to the journal.

- Click on tags dropdown will appear

- Added tags, created contacts and item will appear in the dropdown

- A new tag can be created by clicking on Add tag

- Enter the tag name and description and click on save

- Created will be updated in the dropdown

- Choose the tag from the dropdown

- Enter the date

- Enter reference number

- Press upload to upload a file

Journal Item Details,

- Select Account from the dropdown menu

- Enter description if needed

- Enter the amount in debit

- Select another account from the dropdown menu

- Enter a description if needed

- Enter the amount in credit

- Amount entered in debit and credit should be equal

- If the journal is not balanced then a message will be displayed that the debit is not equal to credits

- Save option will be blocked when the journal is not balanced

- Once the journal is balanced then the save option will be enabled

- Press save to save the journal