When a company order goods from a supplier, they raise a Bill, when the goods or services arrive they will receive an invoice from the supplier. If the goods or services match the bill, then details of the invoice are entered into the vendor payment, it helps to track how much money is going out of the business.

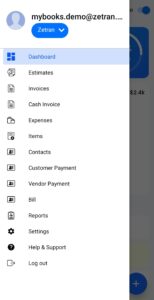

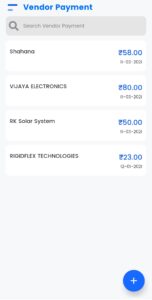

In myBooks, select vendor payment, the vendor payment list page opens. There you can find the list of created vendor payments.

How to Create a Vendor Payment

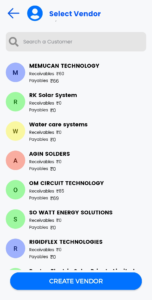

- Click on the “+” icon to add an item

- You can select the created vendor from the list or can create a vendor by a click on create vendor. Enter the details of the vendor & save them to create vendor payments. You can import from your contacts to create a vendor payment

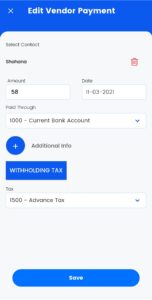

- Enter the amount and date

- Select the account from the drop-down under paid through

- Add the transaction charges if you want to enter

- Select the Transaction account from the drop-down

- Enter the transaction amount

- Click on additional info to update the payment mode

- You can mention the details under reference

- If it is including tax, then select withholding tax to update the tax account. You can either select from the drop-down or click on add tax to create a tax account

- Then click on save

How to Edit a Vendor Payment

Click on the created vendor payments, the edit vendor payment page opens. There you can make the changes as you want then click on the save option in order to save the changes.

How to Delete a Vendor Payment

To delete the created vendor, go to the vendor payment you want to delete and swipe from right to left. Alert message will show on the screen for confirmation. Click on YES to delete permanently.