Part of the profits or the income earned by the business had been paid to the government as taxes. When goods are taxed, a percentage of their price of the goods has to be paid to the government. Here you can add taxes and once the tax codes are created you can group those tax codes as well in myBooks. When creating tax codes and sales and purchases account will be updated by default and the user can change the purchase and sales account. Select the tax authority from the dropdown or a new tax authority can be created as well.

How to get there!

How to get there!

To create tax in myBooks click on Settings> Business settings > Tax Management.

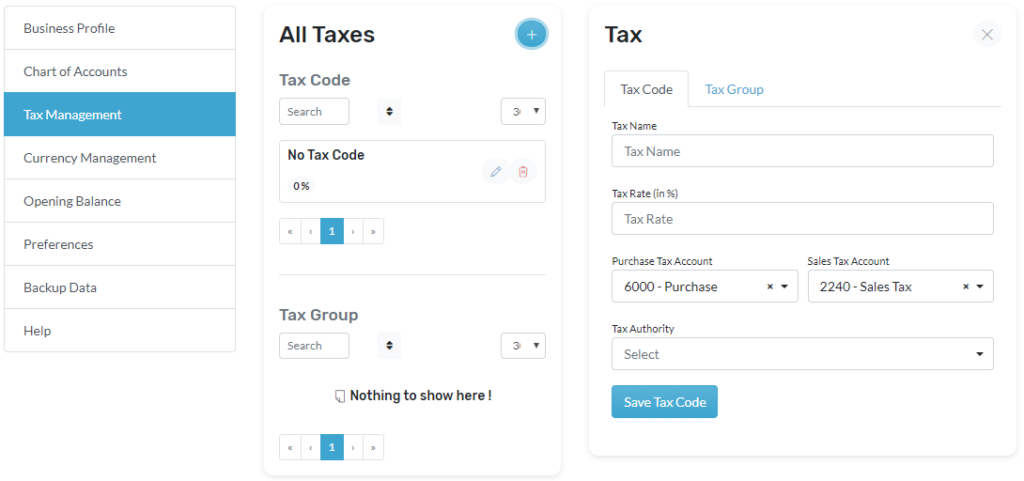

Create Tax Code,

Tax code – Set of rules and regulations provided by the tax authority and which needs to be met by the people in terms of taxation.

- Click on tax management

- To add New Tax, Click on Add New Tax Code located top right-hand corner

- Provide a Tax Name

- Enter the Tax percent

- By default purchase and sales tax account will be selected, these accounts can be changed

- Select the tax authority from the dropdown list or create a tax authority

- Enter the tax department name and choose the state from the dropdown. Click save to add the tax authority

- Once the tax authority is added then select the tax authority from the dropdown.

- Click Save to add the tax code

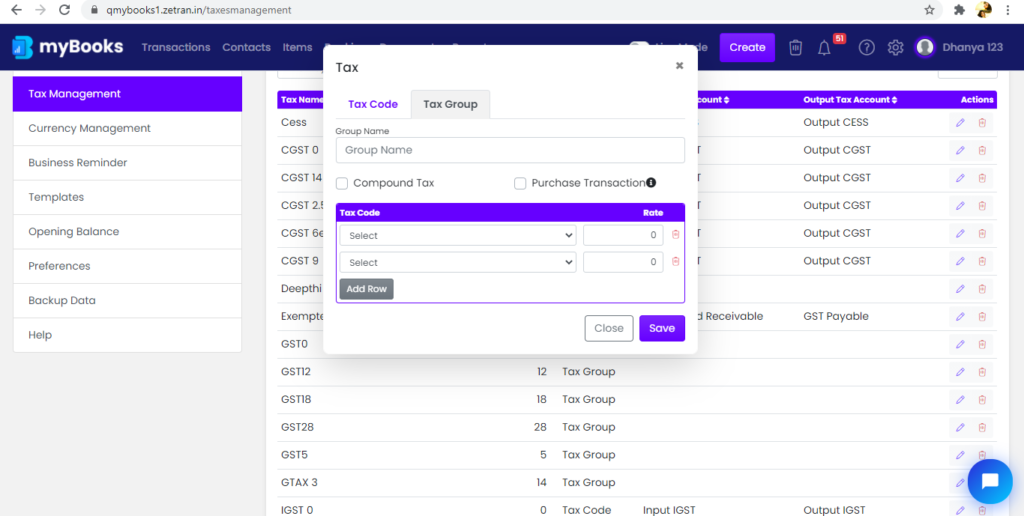

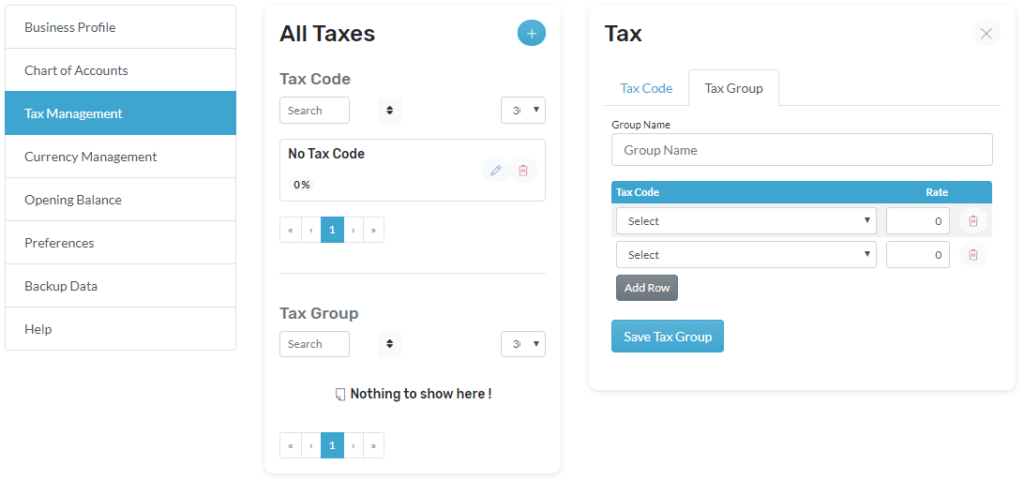

How to create tax group

Tax Group – is a consolidation of tax codes. Where you can combine a list of tax codes into a tax group. Here will show you how to combine a list of tax codes into a tax group.

- Click on tax management

- To add a New Tax group, Click on Add and then click on the group

- To create a tax group need at least 2 tax codes

- Select the tax code from the dropdown list

- Tax percentage will be updated automatically but it can be modified also.

- Click Save to add the tax group

Compound Tax Implementation in all Transaction:

The compound tax option can be turned on for the existing Tax group and newly created tax as well. Once the compound tax flag is raised in the Tax group. It will get impacted over the transactions when you use that tax group.