Vendor Credit note is a transaction that reduces the money owed to the vendor for future transactions. When the vendor credit is created amount owed to the vendor will be reduced by the amount of credit issued.

How to get there!

How to get there!

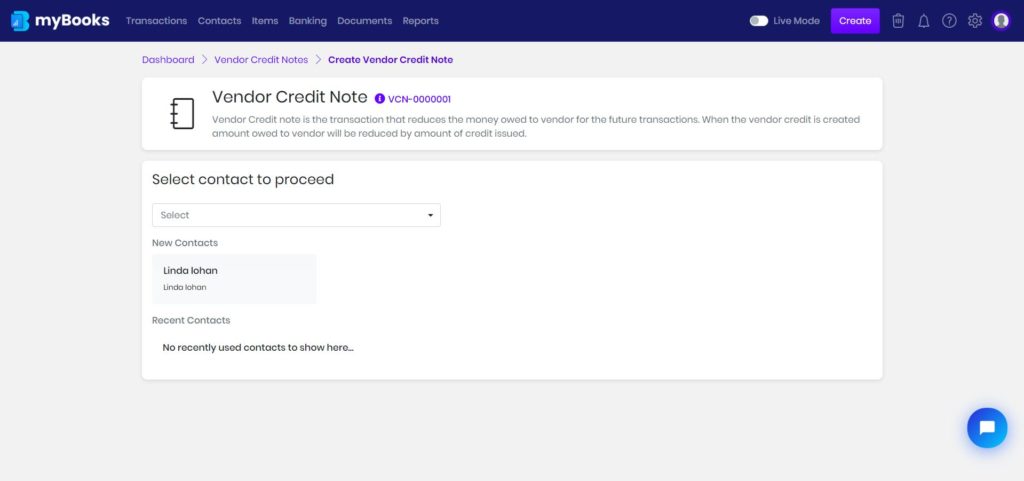

To create a Vendor credit note in myBooks click on Transactions > Vendor credit notes> Create vendor credit note or click on Create which is located in the top right-hand corner and then click on the Vendor credit note.

Select the vendor from the dropdown or new contact can be created by clicking on add new contact.

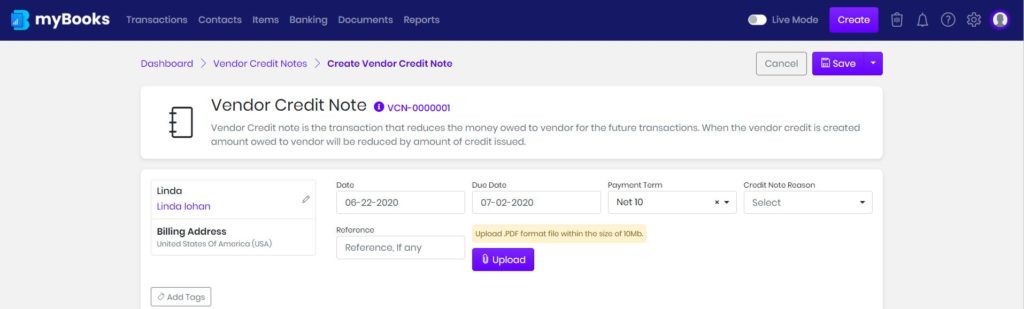

Vendor Credit Note Header Details

Choose the date from the calendar and then the terms will be updated if it was linked to the vendor. Due date will be updated automatically based on the terms, it can be changed if needed. Credit note reason can be added to the transaction by selecting from the dropdown or a new credit note reason can be added by clicking on + Add reason.

To add tags to the transaction, click on tags and select from the dropdown. By default created contacts and items will be added as tags automatically.

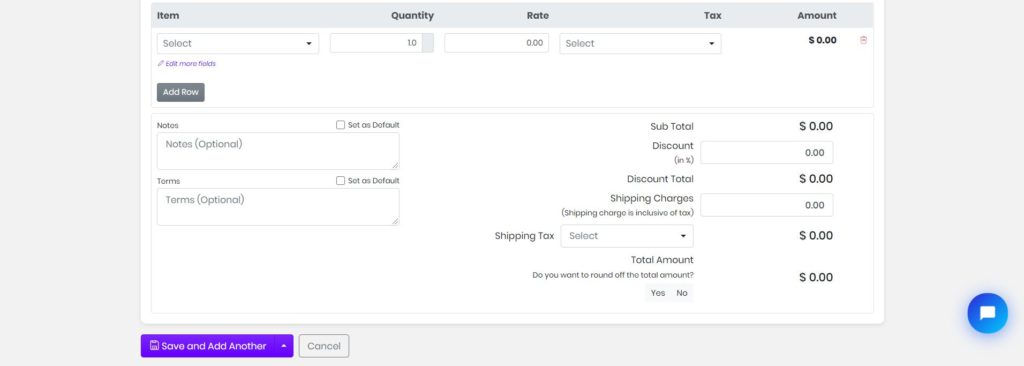

Enter your Vendor Credit Note Line Items

Select the item from the dropdown menu, the description, quantity, and the rate will get updated automatically. You can adjust these details as required including the item description. If inventory management is enabled then stock, Number of stocks available will be displayed.

If tax was updated, when the item was created, the tax field will get updated automatically. If not, then the tax needs to be updated manually.

Discount and shipping charges can be entered in their respective fields. Further, you can setup terms and notes add them default if you want them to appear on all the transactions.

You can save the vendor credit note as a draft or click on save to save the vendor credit note.